Insolvencies of Mt. Gox & FTX: Tax Classification of Repayments in Germany

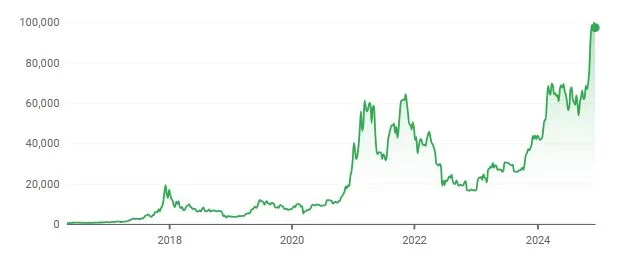

The insolvencies of Mt. Gox (2014) and FTX (2022) affected thousands of investors and caused significant losses. Since 2024, repayments from the insolvency proceedings have been made, partly in fiat currency (e.g. EUR, USD) and partly in cryptocurrency (e.g. bitcoin).

The tax treatment of these repayments is not unimportant for investors. We shed light on the differences between business assets and private assets and use two examples to show how taxation works in Germany depending on the circumstances.

Mt.Gox - A mountain of questions

Founded in Japan in 2010, Mt.Gox was the first bitcoin exchange worldwide. By 2014, up to 80 percent of all bitcoin transactions were processed via Mt.Gox.

Due to security vulnerabilities in the software, Mt.Gox gradually lost several hundred thousand bitcoin by 2014, ultimately resulting in a near total loss. The full extent of the catastrophe became apparent in February 2014 with the filing for insolvency. The initially small insolvency estate grew to a considerable sum, which even exceeded the nominal claims. Since then, a large number of international creditors have been fighting for their claims.

What is Mt.Gox?

Founded in 2010, Mt.Gox was the first bitcoin exchange (trading platform) in the world. The company was and is based in Japan. A bitcoin exchange enables its users to trade crypto assets by creating a market for them. To this end, money and crypto assets, in this case bitcoin, are transferred on the exchange, which can then be used for trading.

By 2014, a substantial proportion of all bitcoin transactions worldwide were carried out via Mt.Gox. The market share amounted to up to 80 percent of the global volume. Mt.Gox held around 850,000 bitcoin for these purposes, both its own and others'. After these were stolen, Mt.Gox had to file for bankruptcy and is now under the administration of a trustee.

What happened to the bitcoins?

Mt.Gox had lost about 850,000 bitcoins by the time it filed for bankruptcy. The events that led to this can be traced back to several incidents.

During the sale of Mt.Gox between Jed McCaleb and Mark Karpelès, approximately 80,000 bitcoins flowed out of the Mt.Gox wallet without a record of any receipt for it. This deficiency was also discussed by the parties, as revealed in chat transcripts released during the criminal trial in the USA.

These 80,000 bitcoins flowed out of the Mt.Gox hot wallet to the - now known - wallet address of 1FeexV6bAHb8ybZjqQMjJrcCrHGW9sb6uF. They remain there, untouched to this day, at least until the private key is found.

Facts in detail:

How could so many bitcoins have been stolen?

It is still unclear how this theft could have happened. Part of the responsibility for this certainly lies with the operators, who did not ensure sufficient data security. At the beginning of March 2011, the wallet.dat file, which is responsible for all transactions, was copied from the servers.

Due to the compromised wallet.dat file, hackers managed to transfer approximately 650,000 bitcoins directly from Mt.Gox's hot wallet to third-party accounts. These thousands of transfers were long lost in the millions of legitimate transactions but could be reconstructed from the data that became public. To date, approximately 630,000 of the lost bitcoins have been tracked from Mt.Gox's wallet. These were most likely liquidated via several intermediary wallets, obfuscation services and ultimately other exchanges.

Has anyone been held accountable for the acts?

300,000 bitcoins ended up on the BTC-e exchange. The central figure of this exchange is Alexander Vinnik, who has been accused of having "laundered" the stolen bitcoins through the site he co-founded. In 2017, he was arrested in Greece through efforts by U.S. authorities on charges of laundering 4,000,000,000 USD through BTC-e. In France, he was sentenced to five years in prison for this. In principle, it is possible, even if unlikely, that larger quantities from Mt.Gox are to be found among the bitcoins seized by BTC-e and returned to the insolvency estate.

More detailed information on the exact events can be found under https://blog.wizsec.jp/. The WizSec collective consists of experts in cryptotechnology and cybersecurity and has provided extensive insight into their investigations since the events surrounding Mt.Gox began.

Timeline of the Mt.Gox insolvency

2010 |

18.07.2010: Jed McCaleb (American entrepreneur and later also known for Stellar and Ripple) founds Mt.Gox as the world's first bitcoin exchange |

2011 |

02.2011: McCaleb sells Mt.Gox to Frenchman Mark Karpelès 01.03.2011: Loss of approx. 80,000 bitcoins with the transfer of Mt.Gox 05.2011: Theft of 300,000 bitcoins and subsequent restitution after the payment of a finder's fee 19.06.2011: Compromising of an administrator account to manipulate the market 09.2011: Wallet.dat file, which provides access to the company's bitcoin holdings, is copied by unknown persons |

2011-2013 |

Outflow of almost 630,000 bitcoins enabled by the copied wallet.dat file Erroneously granted deposits lead to a loss of approx. 40,000 bitcoins |

2013 |

20.06.2013: Disbursement problems of fiat currencies in, for example, U.S. dollars and euros, begin |

2014 |

07.02.2014: Withdrawal stop of all payments, including bitcoins 24.02.2014: Mt.Gox website goes offline 28.02.2014: Mt.Gox files for bankruptcy in Japan 09.03.2014: Mt.Gox files for bankruptcy in the USA |

2017 |

07.2017: Arrest of an individual, presumably responsible for the thefts, in Greece 10.2017: Foundation of the creditor community MtGoxlegal.com 11.2017: Creditors apply for transfer to self-administered insolvency (Civil Rehabilitation) 03.2017: Sale of approx. 40,000 bitcoins to cover the liquidity of the insolvency estate |

2018 |

22.06.2018: Approval of the application and start of preparation for self-administered insolvency |

2020 |

15.12.2020: Submission of the Civil Rehabilitation draft to the court |

2021 |

21.02.2021: Court approval of the Civil Rehabilitation plan 31.05.2021: Start of the vote of the creditors' meeting on the self-administered insolvency proceedings 08.10.2021: End of the vote 20.10.2021: Date for adoption of the Civil Rehabiliation through the creditors' meeting |

2022 |

From 2020: Disbursement of ELSR and IR |

How will the Mt.Gox case be processed?

As Mt.Gox is based in Japan, the liquidation of the company will be carried out under Japanese law. In this case, "normal" insolvency proceedings were filed due to a lack of assets, which means that assets are divided among the creditors in fractions. The creditors' claim was valued at the bitcoin rate at that time. Otherwise, the insolvency rates would have been very low.

However, in the course of the insolvency, a forgotten wallet, i.e. a storage medium for bitcoins, was found at Mt.Gox. This was used until June 2011 and contained approx. 200,000 bitcoins which were thus made available to the insolvency estate again. Due to the price increase of bitcoins since 2017, the value of the insolvency estate grew strongly and, in the meantime, has even exceeded the nominal value of the liabilities many times over.

Then there was the emergence of bitcoin cash (BCH). This is a hard fork of the bitcoin blockchain, i.e. a split of the bitcoin project. In this context, the same amount of Bitcoin Cash was issued to each holder of bitcoins, which, in this case, also benefited the insolvency estate.

In the course of these events, a petition was filed at the behest of a group of creditors to convert the insolvency into a Civil Rehabilitation in order to avoid the initial lower claims being settled and the price gains being accrued to the shareholders. Through Civil Rehabilitation, it is possible not only to settle the debt in yen but also to issue bitcoins and BCH.

With the conversion of the insolvency into a Civil Rehabilitation, the revaluation of the claim was carried out at market value. To secure the liquidity of the estate, the insolvency administrator also sold several thousand bitcoins. This leaves approximately 140,000 bitcoins for distribution in the insolvency estate.

Insolvencies of the crypto exchanges

Mt. Gox

Mt. Gox was the first major cryptocurrency exchange before it filed for bankruptcy in 2014 after losing over 850,000 BTC - both in Japan and in the USA. As the insolvency estate grew, the insolvency in Japan was converted into a civil reorganization (minji saisei) at the request of a group of creditors.

With the conversion of the insolvency into a civil reorganization, the coins were revalued at market value. One bitcoin was valued at 749,318.83 yen and one BCH at 97,481.19 yen. Since then, these values have been used to calculate the payments to the insolvency creditors from 2024 onwards. The proceedings have not yet been concluded.

The repayments to creditors were made partly in bitcoin, bitcoin cash and partly in fiat currency. The payouts were based on a fixed exchange rate of (from today's perspective: only) USD 483/BTC from 2014, which may also be relevant for the tax valuation.

FTX

FTX, one of the largest crypto exchanges, filed for bankruptcy in 2022. Repayments depend on the realization of the remaining assets and will also be made partly in fiat currency and partly in cryptocurrencies. The first payouts are expected in March 2025.

Rights of creditors in a crypto insolvency

In order to clarify the tax consequences of the repayments from the insolvencies, the first question to be answered is whether the investors are entitled to separation or segregation rights, i.e. whether the compensation payments represent the repayment of their own coins. This is not the case in either of the two insolvencies, Mt. Gox or FTX. As the customer funds on both platforms were not held separately from the company's assets, the investors are only entitled to claims against the insolvency estate, but not to the repayment of “their” specific coins that they had in their account at the time of the insolvency.

It can therefore be assumed that the original investment was initially lost as a result of the insolvency - which does not constitute a sale for tax purposes within the meaning of Section 23 of the German Income Tax Act (EStG) and would therefore be irrelevant for tax purposes.

The individual investor would then have a (new) monetary compensation claim against the insolvency administrator. The servicing of such a claim is also irrelevant for tax purposes.

However, if the payment is made in cryptocurrencies, this could be seen as an exchange of the insolvency claim in fiat currency for a claim in crypto. This means that at the time of the choice to be compensated in crypto, a new acquisition of the distributed coins could be seen, which in turn is important for the question of whether the distributed coins can be sold immediately tax-free or whether the one-year holding period under Section 23 EStG must be observed.

Not your keys - not your coins! Does this also apply to tax law?

The ability to hold cryptocurrencies in your own wallets independently of exchanges or banks and to take full responsibility for their safekeeping is considered one of the great achievements of blockchain. Whenever centralized exchanges have suffered major losses due to hacker attacks, the crypto-affine media have reminded us that damage caused by such hacker attacks on exchanges can be avoided simply by the investor holding the crypto assets themselves and managing the corresponding private keys themselves. “Not your key - not your coins!” is a reminder that as long as coins on exchanges are held in third-party custody, the security of the crypto assets stored there is not guaranteed.

The question that now arises is whether coins that investors hold on a crypto exchange are no longer treated as their assets for tax purposes. Is a coin in the investor's own wallet a different asset to a coin in the collective wallet of a crypto exchange? Under civil law, there may be considerable differences here. Under civil law, the crypto assets on an exchange may only represent claims against the exchange. But is this also relevant for tax purposes?

The German Federal Ministry of Finance (BMF) explains the term wallet in its letter dated 10.05.2022. With regard to trading platforms, the BMF writes

- “in some cases, a common wallet is also used for a large number of people, in contrast to the above description.”

And further:

- “For the time of acquisition or disposal, (...) trading via the platform is decisive. The same applies if taxable persons do not have their own wallet, but the units of a virtual currency or other token are held in custody by the trading platform.”

For tax purposes, the BMF therefore always treats coins and tokens acquired on a trading platform as the investor's own. This means that even in the event of a disruption such as insolvency, the tax status of the coin does not change. The coin is still deemed to have been acquired by the participant at that time and for that amount. This is a fiction that the tax authorities have established independently of the actual allocation under civil law and to which they have bound themselves through the BMF letter dated 10.05.2022.

Business assets vs. private assets in the event of crypto insolvency

Depending on whether the coins lost through insolvency were held as business assets or private assets, and depending on whether repayments are made in cryptocurrency or fiat currency, the tax treatment differs considerably.

Business assets

If the lost coins were held as business assets and have been reflected in the determination of profits for tax purposes as a loss of the business (business expense or individual value adjustment) as a result of the insolvency, the following tax consequences apply:

- Repayment in fiat currency: Repayments in fiat currency (e.g. euros) are taxable as operating income (or dissolution of the initial specific valuation allowance).

- Repayment in cryptocurrency: The receipt of cryptocurrencies is initially tax-neutral, as it is merely a retransfer of the company's own coins. However, these remain part of the business assets. If only part of the originally held coins are retransferred, i.e. the remaining coins are now permanently lost, a final loss is then realized in this respect, but only in the amount of the pro rata acquisition costs at the time.

A subsequent sale of the recovered coins constitutes operating income at market value/sale value.

Private assets

The rules for private sales transactions apply to private assets (Section 23 EStG). The tax treatment depends on whether fiat money or cryptocurrency is repaid:

- Repayments in fiat currency are generally tax-neutral, as they merely offset the loss. However, any surplus (e.g. additional interest payments) would be taxable as other income (Section 22 No. 3 EStG). In the case of Mt. Gox, however, this does not play a role, as in this case it is a matter of non-interest-bearing receivables.

- Repayment in cryptocurrency: The coins were acquired at the time and at the acquisition cost at that time. In the insolvency, the price of USD 483/BTC and the time of acquisition in 2014 were then used for the distribution calculation. It is obvious that the speculation period has long since expired since this acquisition. In the opinion of the BMF, the coins on the platform are those of the respective investor for tax purposes, which means that the payouts to the investor are irrelevant for tax purposes. Subsequent sales of the cryptocurrencies received back also remain tax-free because the one-year period has expired many years ago, even if a sale takes place immediately after the distribution. Some tax authorities may take a different view, but we do not believe this is correct.

Examples of losses from crypto insolvencies

Example 1: Coins in business assets

Facts:

- In 2013, 25 BTC were mined on a private computer.

- The market value at the time was USD 100/BTC. The 25 BTC were booked to business assets at this value (USD 2,500), as mining is a commercial activity.

- The taxpayer continued to hold the BTC as business assets and transferred them to Mt. Gox in 2013 in order to store or trade them there.

- In 2014, Mt. Gox became insolvent and the taxpayer lost access to the 25 BTC.

- The taxpayer receives 5 BTC and EUR 50,000 back from the insolvency in 2024.

- The market value of a BTC in 2024 is EUR 30,000. 5 BTC are therefore worth EUR 150,000 in 2024.

- Fiat money = EUR 50,000

Tax treatment:

- Fiat currency: The EUR 50,000 are recognized as operating income.

- Cryptocurrency: The 5 BTC are initially recognized directly in equity as a transfer from the “own” wallet at the acquisition cost at the time. A subsequent sale of the 5 BTC leads to a taxable gain or loss, depending on the sales value. If the insolvency is completed, the unreimbursed coins are derecognized as a loss at their acquisition cost (if not already done).

Overall impact:

The taxable profit for 2024 initially increases by a total of EUR 50,000. If sold promptly, the market value would be further operating income (EUR 150,000 BTC).

Example 2: Coins in private assets

Facts:

- In 2013, 25 BTC were mined on a private computer.

- Mining was discontinued after two months. The taxpayer has thus given up any commercial operation (if the activity was ever commercial at all).

- The 25 BTC were therefore transferred to private assets at their then market value of approx. USD 100/BTC (USD 2,500).

- The 25 BTC were then transferred to Mt. Gox in order to store or trade the coins there.

- In 2014, Mt. Gox became insolvent and the taxpayer lost access to the 25 BTC.

- The taxpayer receives 5 BTC and EUR 50,000 back from the insolvency in 2024.

- The market value of a BTC in 2024 is EUR 30,000. 5 BTC are therefore worth EUR 150,000 in 2024.

- Fiat money = EUR 50,000

Tax treatment:

- Fiat currency: Repayments in fiat money are tax-neutral as they do not exceed the original loss.

- Cryptocurrency: The transfer of the coins is a repayment of the coins attributable to the investor, which were already transferred to the exchange in 2013. At that time, the coins were no longer attributable to business assets and therefore constitute assets within the meaning of Section 23 EStG. As the one-year period has already expired, a prompt sale would also be tax-free in any case.

Overall effect:

The taxpayer can immediately sell the cryptocurrencies received back tax-free. The inflow does not constitute a new acquisition. Acquisition costs and acquisition dates result from the original purchases. The fiat money also remains tax-free.

WINHELLER advises on payouts from crypto insolvencies

The tax treatment of repayments from insolvencies of crypto exchanges such as Mt. Gox or FTX depends crucially on whether the coins were held as business assets or as private assets.

- Business assets: Repayments in fiat lead to taxable business income. Repayments in cryptocurrencies are initially a tax-neutral transfer. A subsequent sale of the cryptocurrencies is taxable. The acquisition costs of the unreimbursed coins must be derecognized as a loss at the latest when the insolvency is concluded.

(Of course, the specific accounting treatment both upon entry into insolvency and for subsequent reimbursements depends on whether a balance sheet or merely an income surplus statement is prepared). - Private assets: repayments in fiat money are tax-neutral and repayments in cryptocurrencies are tax-free. Repayments in cryptocurrency are not considered a new acquisition and can therefore be sold immediately and completely tax-free without waiting for a further year.

Some uncertainty remains with regard to the peculiarity that claims in the Japanese insolvency system are denominated in YEN by law. As a result, the investor's choice to request payment in crypto instead of YEN could be regarded as an exchange between the foreign currency claim in YEN and the cryptocurrencies. (In our opinion, the fiction of the attribution of the wallets in the BMF letter stands in the way of this, irrespective of the civil law assessment). In this case, a (new) one-year period would have to be waited from the time of the election in order to then be able to sell the BTC and BCH received tax-free.

Your advisors for crypto insolvencies in Germany

Our experts will help you to ensure legal certainty and shed light on your tax and legal situation with regard to Mt Gox, FTX or another insolvent crypto exchange. Our contact persons are at your disposal at any time. Please contact us at mtgox@winheller.com for more information!

If you have any further questions regarding tax law or criminal tax law complications, our experts are always available for you.

Do you need support?

Do you have questions about our services or would you like to arrange a personal consultation? We look forward to hearing from you! Please fill in the following information.

Or give us a call: +49 69 76 75 77 85 28