Trading Company for Crypto Assets in Germany

Many crypto investors in Germany can optimize their taxes with the help of a trading limited liability company (Gesellschaft mit beschränkter Haftung, GmbH). This is especially true for private investors who have a high trading volume and who work with

-

shares,

-

options or

-

forward transactions.

The same applies to private crypto investors who trade in crypto derivatives and futures, as well as arbitrage and high-frequency traders who record a large number of crypto transactions. They can all benefit from the tax advantages of a trading GmbH.

What is a trading limited liability company/trading GmbH?

A trading limited liability company is legally no different from a standard limited liability company. However, a trading limited liability company is usually limited to the pursuit of a specific purpose, namely trading in shares, options or forward transactions and other asset management, unless subject to BaFin authorization. Income in connection with the trading limited liability company is generally taxed at around 30 percent (corporation and trade tax) as is the case with all other LLCs.

What are the advantages of a trading company?

First of all, the establishment of a trading GmbH can be attractive from a tax perspective, in particular for share trading. Profits that arise due to a sale of shares are in fact subject to considerable preferential tax treatment.

For share proceeds, a tax burden of only approx. 1.5 percent is incurred within the limited liability company, which is why the profits are as good as tax-free. This makes it possible to develop assets significantly faster than in private investment.

Another advantage is, for example, the comparatively favorable taxation of distributions from equity ETFs (tax burden approx. 12.165 percent).

An example of a trading LLC:

If, with the help of a trading company, a share is bought at a price of EUR 100,000 and sold after a time at a price of EUR 200,000, the profit is EUR 100,000. Due to a statutory tax exemption of 95 percent, only EUR 5,000 of this amount must be taxed in the context of a limited liability company.

This amount (EUR 5,000) is then subject to about 30 percent corporation and trade tax, which results in a total tax burden of only EUR 1,500 (1.5 percent).

Reinvest profits in the limited liability company

In addition to this considerable tax advantage, however, it must not be disregarded that taxes are again incurred for the disbursement of the realized net profits in private assets. The basic idea is therefore to keep the profits within the limited liability company for as long as possible and to reinvest them again in order to achieve long-term benefits from the tax advantage due to the compound interest effect.

On the other hand, anyone who invests in shares privately - as a counter-example - bears a tax burden of EUR 25,000 due to the final withholding tax (flat rate of 25 percent plus solidarity surcharge and, if applicable, church tax) on a profit of EUR 100,000.

Trading company attractive for crypto investors

On the other hand, a trading LLC can also offer added value for commercial crypto investors. Above all, commercial crypto traders who appear as arbitrage and high-frequency traders and record a large number of crypto transactions should consider establishing a trading limited liability company.

Without their establishment, any profits made are taxed at their progressive personal income tax rate of up to 45 percent. In addition, trade tax is incurred, but this can be taken into account with the income tax and therefore plays only a minor role.

Profits within the scope of the trading limited liability company, on the other hand, are taxed on the basis of the fixed tax rate of approx. 30 percent (corporation tax and trade tax), irrespective of the amount of the profit. So the higher the profit of the company, the greater the tax benefit. And unlike private assets, trading losses from crypto investments in the GmbH can always be offset even if the one-year holding period under Section 23 EStG, which only applies to private assets, has not yet expired.

Active crypto traders often carry out thousands of crypto transactions. They all have to be fully recorded in the accounts, which creates major difficulties for the taxpayer. Our software solution CoinRacoon provides a remedy. With this, thousands and thousands of complicated crypto transactions can be automated and transferred to the financial accounting in a legally secure manner - a huge time and cost saving!

Trading LLC can offset losses from forward transactions without limitation

Due to an amendment to the German Income Tax Act, losses from forward transactions for private individuals without a trading GmbH can only be taken into account to a limited extent when offsetting losses from 2021 onwards.

Traditional private investors who trade in options are not the only group facing a massive tax disadvantage as a result. Crypto investors who trade crypto derivatives and futures on exchanges such as BitMEX, Kraken Futures or HTX are also equally affected by the law change.

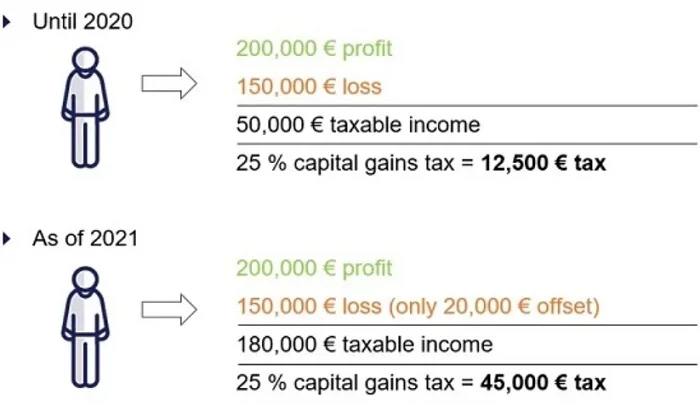

Among other things, the offsetting of losses from forward transactions is limited to EUR 20,000 per year, which, in effect, leads to a minimum taxation of profits.

The negative consequences for private investors are shown in our chart.

Instead of EUR 12,500 in taxes, the taxpayer now pays a full EUR 45,000. Compared to the previous legal situation, this means that 3.6 times more taxes are due. Due to the enormous tax risk involved, forward transactions are impractical for the vast majority of private investors. In the worst case scenario, the restriction on offsetting losses can even pose existential risks for private investors if they have to pay taxes on high, purely fictitious profits that they cannot afford.

However, this tax trap does not apply to a trading LLC. Since a limited liability company always generates commercial income, the limited offsetting of losses does not apply to a trading company. Losses can therefore still be claimed without restriction. For both traditional investors and crypto investors, the establishment of a trading limited liability company can therefore be attractive from a tax perspective.

WINHELLER accompanies your foundation of a trading company

Are you interested in setting up a trading GmbH? Are you making high profits trading traditional financial products or crypto derivatives and futures and want to optimize your taxes? Do you have any further questions about setting up a trading limited liability company?

The best way to reach us is by e-mail (info@winheller.com), by telephone (+49 69 76 75 77 85 28) or via our contact form for the taxation of cryptocurrencies.